Key Points:

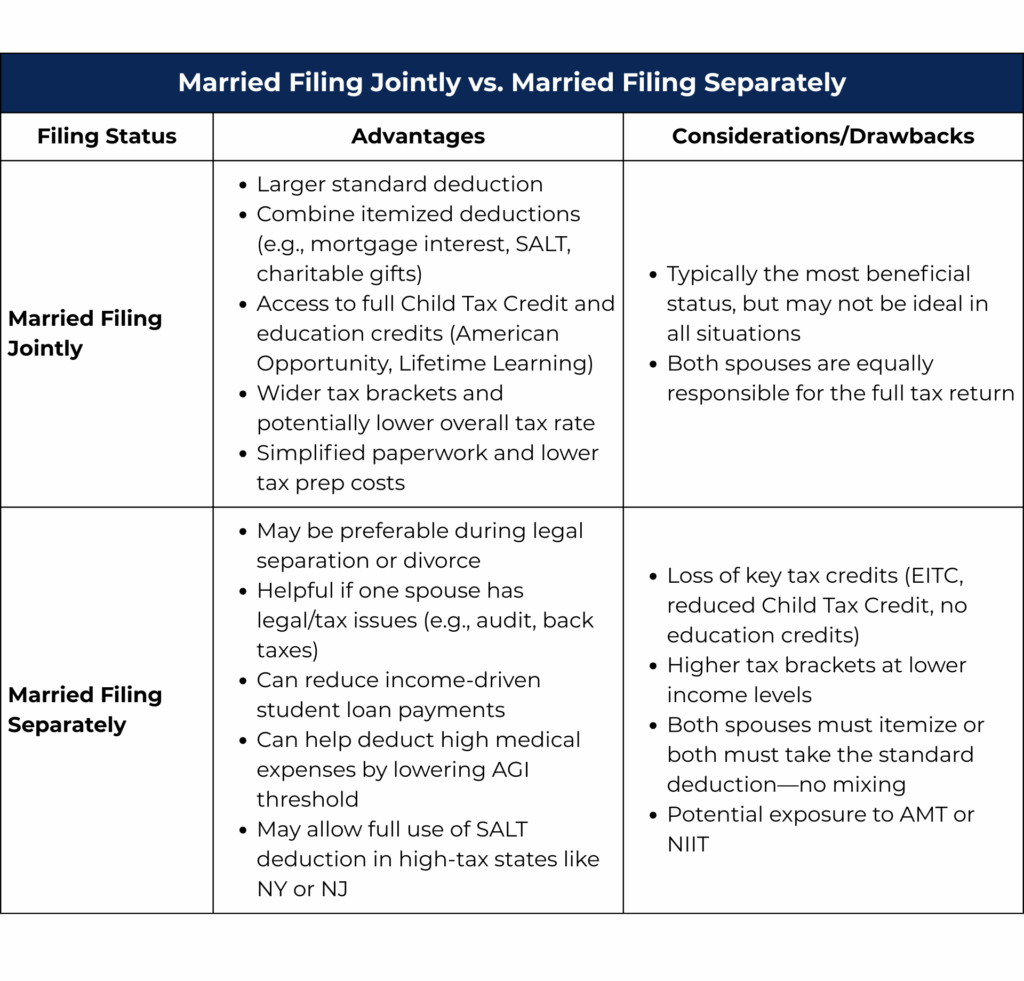

- Filing jointly is usually the most tax-efficient option for married couples, offering access to more credits, wider tax brackets, and the ability to combine deductions.

- Filing separately may be worth considering if you’re dealing with legal separation, significant medical expenses, student loan repayment strategies, or state-specific tax scenarios that impact your bottom line.

- Running the numbers or working with a financial planner can help you make a confident, informed decision that supports your long-term goals.

Table of contents

How you file your taxes as a married couple is more than just checking a box. It can also have a significant impact on your financial life. For high earners in particular, the decision to file jointly or separately can affect your total tax bill, your eligibility for valuable credits and deductions, and even things like college financial aid.

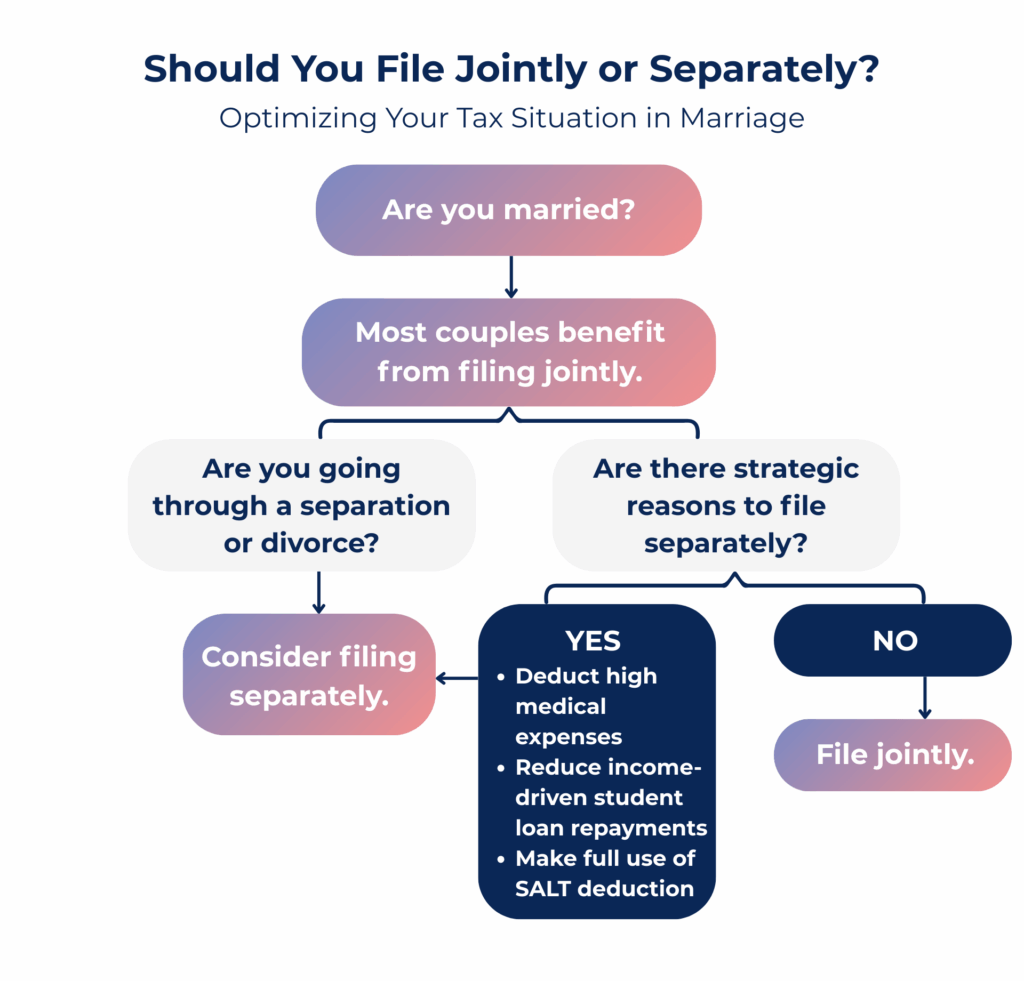

Filing jointly is typically the most tax-efficient option, but that’s not a hard-and-fast rule. In some cases, like when one spouse has high medical expenses or significant student loan payments, filing separately could be the better move.

This post breaks down the key differences between the two filing statuses, highlights scenarios where one might be more beneficial than the other, and offers guidance to help you make the choice that best supports your financial goals.

Filing Status Basics

Married couples have two options for their federal tax filing status:

- Married Filing Jointly (MFJ)

- Married Filing Separately (MFS)

Most couples choose to file jointly, combining their incomes and deductions into one return. Filing separately, on the other hand, means each spouse reports their income and deductions on their own individual return.

This decision matters more than you might think. Your filing status determines your tax bracket, the size of your standard deduction, and whether you qualify for certain tax breaks like the Child Tax Credit or education-related credits.

In most cases, filing jointly offers a larger deduction and lower overall tax rates, making it the more financially advantageous choice. But there are exceptions where filing separately could help minimize your tax liability or protect your financial interests.

Understanding the basic differences is the first step in choosing the filing status that best supports your goals.

Benefits of Filing Jointly

Filing jointly typically offers married couples the most tax advantages, starting with more favorable deductions and access to valuable tax breaks.

While the standard deduction is doubled for joint filers, the benefits can be even greater if you itemize. By filing together, you can combine mortgage interest, charitable contributions, state and local taxes (up to the SALT limit), and other deductible expenses into a single return, potentially increasing your total deductions and lowering your taxable income more than if you filed separately.

Filing jointly also unlocks several tax credits that aren’t available to separate filers. For example, you may be eligible for the full Child Tax Credit and education credits like the American Opportunity and Lifetime Learning credits, both of which reduce your tax bill dollar-for-dollar.

In addition, joint filers benefit from wider tax brackets, which means your combined income is often taxed more efficiently. And from a practical standpoint, one return typically means less paperwork and lower tax prep costs.

When Filing Separately Might Make Sense

While filing jointly tends to be the most tax-efficient option for married couples, there are situations where filing separately may be the better choice, especially if your financial or personal circumstances are more complex.

If you’re going through a separation or divorce, for example, you might prefer to keep your finances separate for legal or emotional reasons. Filing separately can also be helpful if you’re concerned about your spouse’s tax situation, like if they owe back taxes, are under audit, or have other legal issues that could affect your return.

Additionally, there might be strategic reasons to file separately. For example, if one spouse has high out-of-pocket medical expenses, filing separately may make it easier to meet the threshold for deducting those costs—currently 7.5% of your individual adjusted gross income (AGI). Similarly, if you’re on an income-driven student loan repayment plan, filing separately can reduce your monthly payments by excluding your spouse’s income.

Filing separately may also increase your total deductions if you live in a high-tax state like New York or New Jersey. For instance, if one spouse pays a significant amount in state and local taxes (SALT), filing separately might allow them to fully use the SALT deduction limit rather than splitting it across a joint return. This strategy can be particularly effective when the other spouse has little or no SALT liability and wouldn’t benefit from the deduction.

Potential Drawbacks of Filing Separately

While there are situations where filing separately makes sense, it often comes with trade-offs. Here are some of the main drawbacks to keep in mind:

- Loss of Tax Credits. If you file separately, you’re not eligible for the Earned Income Tax Credit (EITC), you may only qualify for a reduced Child Tax Credit, and you lose access to education credits like the American Opportunity and Lifetime Learning credits.

- Higher Tax Brackets. Married couples who file separately hit the same tax brackets as joint filers but at lower income levels. This can lead to a higher overall tax bill, especially for high earners.

- Complicated Filing Rules. Both spouses must either itemize deductions or take the standard deduction. You can’t mix and match, which can limit your ability to maximize deductions if one spouse has significantly more deductible expenses.

- AMT or NIIT Exposure. Filing separately may increase your exposure to the Alternative Minimum Tax (AMT) or the Net Investment Income Tax (NIIT), depending on your income and investment profile.

Special Situations to Consider

There are a few special situations that can further complicate the decision to file separately. Here’s what to keep in mind:

- Community Property States. In states like California, Texas, and Arizona, income earned by either spouse is generally considered joint property. Even if you file separately, your income may be split 50/50 on each return, which can reduce the benefits of filing separately and add complexity.

- State Tax Implications. Some states allow you to use a different filing status on your state return than on your federal return. For example, in New Jersey, a couple can file jointly on their federal return but choose to file separately for state purposes, provided they meet certain criteria. These exceptions vary by state and often depend on residency status or specific income sources, so it’s important to review your state’s rules or consult a tax professional before making a decision.

- Financial Aid (FAFSA). Filing separately can impact your child’s eligibility for need-based financial aid. Depending on how your household is structured, MFS status may reduce the amount of aid your child qualifies for.

- Retirement Contributions & IRA Deductions. Income limits for deducting traditional IRA contributions are much lower when you file separately. This could limit your ability to take advantage of certain retirement savings strategies.

Filing Jointly vs. Filing Separately: How to Decide

Choosing between filing jointly or separately isn’t always straightforward. The best way to decide is to run the numbers both ways.

Tax software can help you estimate your liability under each scenario, but if your financial situation is more complex—like if you own a business, have significant investments, or live in a community property state—it’s a good idea to consult a financial planner or tax professional.

It’s also important to consider factors beyond just taxes. For instance, if you’re going through a legal separation, managing debt separately, or prefer to keep finances more independent, filing separately might offer comfort and financial clarity. Transparency and trust between partners play a big role in what feels right.

Finally, keep the long view in mind. What saves you money one year might not be the best strategy over time. The right choice should align with both your current needs and your broader financial goals.

Making the Most of Your Financial Resources

Filing jointly is often the most advantageous option for married couples, but there are important exceptions where filing separately may be the smarter move. The right choice depends on your income, deductions, available tax credits, and long-term financial goals. Taking the time to understand your options and getting the right guidance can help you avoid costly mistakes and uncover opportunities you might otherwise miss.

At Align Financial Solutions, we help women leaders make informed, confident decisions around their income, equity compensation, and tax strategies. If you’re unsure which filing status best supports your goals, or you’re simply looking for a valued partner to help you navigate the financial complexities of your career, we’re here to help. Schedule a 15-minute Align Call to take the first step toward simplifying your finances and pursuing a life with more freedom, clarity, and confidence.

Disclosure:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.