Being charitable is not only a noble act but also a financially savvy one when it comes to tax savings. One such strategy that allows taxpayers to maximize the impact of their giving while also enjoying significant tax benefits is bunching itemized deductions. This article will guide you through the intricacies of bunching charitable contributions, the pros and cons of this approach, and how to implement it effectively.

Key Takeaways

- Bunching itemized deductions: As the itemized deduction threshold has significantly increased over the years, there’s a new opportunity to bunch itemized deductions in one year to take advantage of additional tax savings.

- Bunching charitable contributions: If you find that you are regularly donating to your favorite charity, it might be worth considering bunching the charitable donations to maximize your charitable giving strategy.

- Enhancing giving by donating appreciated assets: It’s even a smarter strategy to give appreciated assets for bunching itemized deductions.

- Using DAF (Donor Advised Fund) for flexible giving: DAF can come in handy to enhance flexibility for charitable giving while bunching the charitable contributions.

What is Bunching Itemized Deductions

Bunching itemized deductions is a tax-saving strategy that involves consolidating two or more years of charitable donations into a single tax year. This method aims to surpass the standard deduction threshold, thereby qualifying for itemized deductions and maximizing tax savings.

The Genesis of Bunching

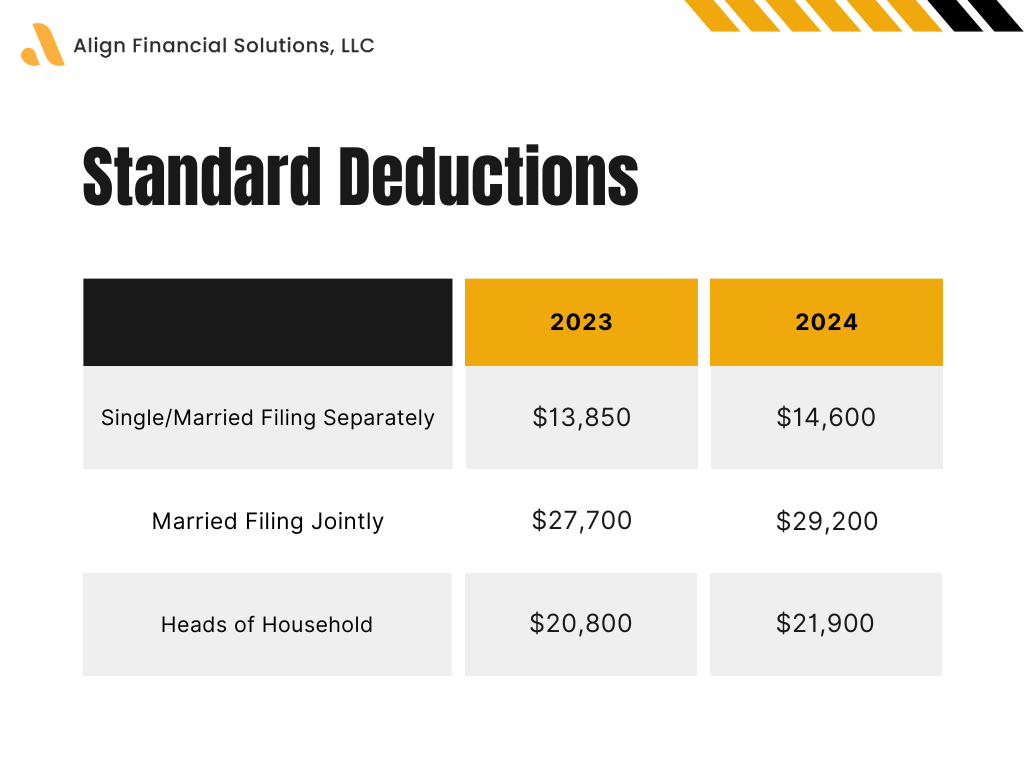

The bunching strategy gained momentum after the Tax Cuts and Jobs Act of 2017, which nearly doubled the standard deduction through 2025. For 2023, the standard deduction is $13,850 for individuals and $27,700 for joint filers. For 2024, the standard deduction is $14,600 for individuals and $29,200 for joint filers.

For an average American taxpayer, these high thresholds make it challenging to qualify for itemized deductions. Herein lies the relevance of bunching. By grouping charitable donations, taxpayers can exceed the standard deduction in one year and opt for itemized deductions for that specific year. Then, they can opt for the standard deduction the following year.

Bunching: Pros and Cons

As with any tax strategy, bunching itemized deductions come with its share of benefits and caveats. You can make informed decisions by knowing the advantages and disadvantages of bunching. After you weigh both sides and determine if this could be beneficial for your unique financial situation, consider consulting with a professional such as your accountant, tax law attorney, and your financial planner.

Pros of Bunching

- Maximized Tax Deductions: By bunching donations, you can surpass the standard deduction threshold and enjoy higher itemized deductions. This can result in substantial tax savings.

- Increased Giving Budget: You can give more by redirecting the tax savings from bunching. How amazing is that to give more by saving more on taxes?

Cons of Bunching

- Requires Tax Planning: Bunching requires careful planning and execution. It’s a multi-year strategy that demands consistent follow-through.

- Potential Distraction: There’s a risk that the focus might shift from supporting charitable causes to chasing tax benefits.

Bunching Tax Strategy Rules

Bunching charitable contributions can be a great tax strategy if used correctly. However, it’s essential to follow specific tax rules for proper implementation.

- Charitable Contribution Deduction Limit: For cash charitable contributions, there’s a limit on deducting up to 60% of AGI, while for non-cash donations like stocks, there’s a limit on deducting up to 30% of AGI.

- Qualifying Charitable Organization: Ensure the organization is a qualifying charity to deduct your charitable contribution amount. Not all non-profits are qualifying charities, so confirm their status before implementing the bunching tax strategy.

- Excess Contribution Carryover: Any unused contribution amount that you couldn’t deduct can be carried over for up to five years. This is due to the limit on charitable contribution deductions, which is based on your AGI for each year.

Implementing Bunching: A Step-by-Step Guide

Implementing the bunching strategy involves a three-step process:

- Assess Feasibility: Before you start, determine if bunching is the right strategy for you. If your itemized deductions, even after bunching, don’t exceed the standard deduction, then this strategy might not be beneficial.

- Plan Your Donations: Decide how you’ll shift your giving. You could consider timing your donations or using a donor-advised fund (DAF).

- File Your Taxes: Ensure you keep track of all your donations and include them correctly in your tax filing. Consult with a tax advisor to ensure proper execution.

Delving Deeper: Planning Your Donations

When planning your donations, you have two primary options: donation timing and using a DAF.

Donation Timing

If you typically make your donations at the end of the year, you could shift your giving to January of the following year. By doing this, you’re pushing your donation into the next tax year.

Using a Donor-Advised Fund (DAF)

If you prefer to donate throughout the year, a DAF can be an excellent tool for bunching. A DAF (Donor-Advised Fund) allows you to contribute money, get an immediate tax deduction, and then distribute the funds to qualified charity over time.

The Donor-Advised Fund (DAF) also offers flexibility for individuals and families who haven’t yet chosen their favorite charitable organizations. They have the freedom to decide on recipients after the gift to the DAF.

How to Use a Charitable Donations Tax Deduction Calculator

A charitable donations tax deduction calculator can be a handy tool when planning your bunching strategy. This tool will help you estimate your potential tax savings from charitable donations.

Charitable Donation of Stock: A Smart Move

Another savvy strategy to consider is the charitable donation of stock. Donating appreciated securities can provide additional tax benefits, including avoiding capital gains tax on the donated stock.

Bunching with Appreciated Assets: Even Smarter Move

You can maximize your giving even more by bunching itemized deductions with appreciated assets, such as real estates and stocks. Charitable organizations that receive appreciated assets can further support their causes with additional funds.

Charitable organizations are not subject to capital gains tax on appreciated assets. Therefore, the impact of giving will be much more significant if you donate your appreciated assets directly to the organization instead of giving the proceeds from the sale of the appreciated assets.

Wrapping Up

Donating to charity not only makes you feel good but also creates a significant difference for a good cause. You get to make a lasting impact by giving gift to charity for the charitable organization you love.

Bunching itemized deductions can be a beneficial strategy for maximizing your tax savings while also increasing your charitable impact. However, it requires careful planning and a clear understanding of the tax laws. Always consult with a tax professional or financial advisor to ensure you’re making the most of your charitable contributions and tax deductions.

Contact us to learn more about how we help individuals maximize their giving with a strategy and tax planning.

Charitable Donations Tax Deduction Calculator

More about Charitable Donation of Stock

Note: This article is intended for informational purposes only and should not be considered as financial or tax advice. Always consult with a tax professional or financial advisor for personalized advice.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities and advisory services offered through LPL Financial, A Registered Investment Advisor.

Member FINRA/SIPC.