This blog post discusses everything you need to know about RSUs (Restricted Stock Unit)—a seemingly simpler form of equity compensation, yet often challenging for tech professionals to navigate. Tech employees have busy schedules and they often prioritize what they are good at or what they enjoy doing. Many of them have entrepreneurial endeavors for their own ventures, apps, or software, which they could potentially fund using RSUs as a means to support these future aspirations.

Navigating RSUs can seem straightforward initially, but their various vesting schedules can lead to oversight. It’s common to overlook these schedules until RSUs accumulate substantially in value, potentially leading to missed opportunities for proactive management. Proactively optimizing RSU assets is crucial, even if understanding the concept is straightforward, managing it actively poses challenges. This blog aims to equip you with insights to manage your RSU assets effectively for future financial optimization, ensuring they work in your favor rather than becoming a surprise tax burden.

Key Takeaways:

- RSUs are taxed as ordinary income upon vesting.

- Holding RSUs beyond the vesting date triggers capital gain/loss tax.

- RSUs show on your paystub with automatic tax withholding, which can be insufficient.

- Executives and insiders face restrictions on trading RSUs freely.

- The grant date signifies promised units, while the vesting date marks actual ownership of stock units.

- Developing a strategy around RSU taxes, in addition to understanding RSUs, can significantly build your asset base from RSUs.

- Proactive management of RSUs is essential to mitigate concentration risk, company-specific risk, and unsystematic risk.

What Are RSUs?

RSUs serve as a widely adopted method for compensating tech company employees. They are typically offered by major corporations or start-ups in advanced stages of development. RSUs can be a great way for companies to reward and incentivize their employees. They provide employees with a unique form of compensation that can help attract and retain top talent, while also providing an attractive investment opportunity. Companies should carefully consider the vesting schedule, since it can play a vital role in motivating employees and ensuring that the RSUs are used as intended. With careful planning, RSUs can be a powerful and effective way for companies to reward their employees. They remain restricted until they reach the vesting date and can be part of a significant aspect of equity compensation packages.

How Are RSUs Taxed?

RSU Tax Treatment

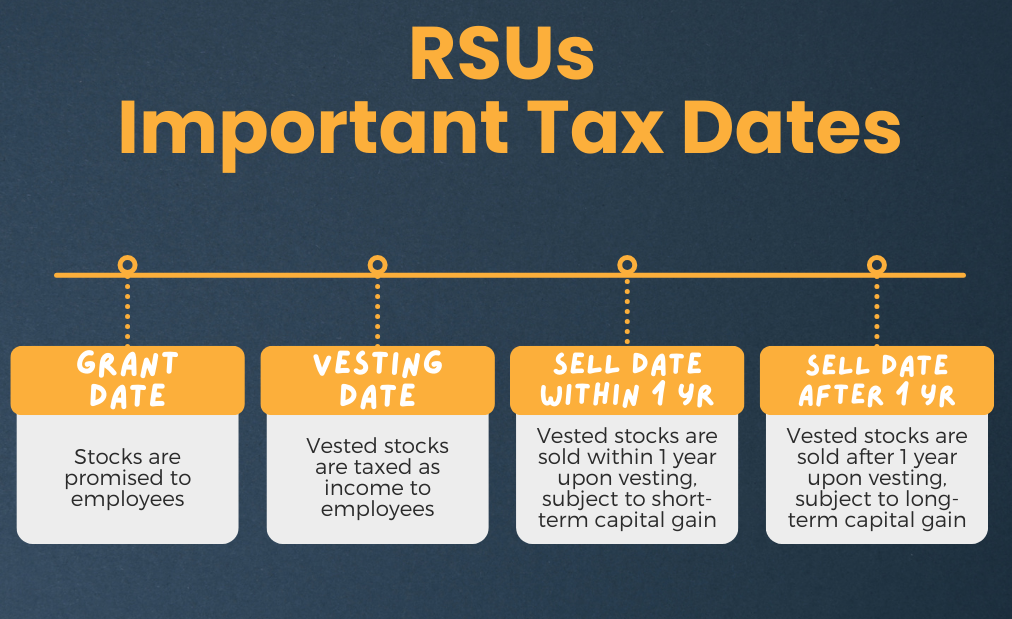

Restricted stock units (RSUs) are a type of equity compensation that is becoming increasingly popular among companies in the current business climate. There are three different dates you need to understand for the RSU tax. The key dates for RSUs tax are:

- The grant date: When the Restricted Stock Units are granted to the employees.

- The vesting date: When the Stock Units are released and become owned by the employees.

- The Sell date: When the shares of the stock are sold by the employees.

These three dates are worth noting. On the grant date, it’s a promise made to employees, contingent upon their continued tenure until the vesting date. Upon reaching the vesting date, which often occurs quarterly for major tech firms, the vested units become part of your income. They are taxed as ordinary income if sold immediately. If RSUs are sold after the vesting date, they are subject to the capital gain tax.

When Can I Sell My RSU Stock?

Once your rsu stocks have vested, you generally have the freedom to trade them, but there’s an important caveat for executives and insiders within the company. Individuals falling into these categories must adhere to both company policies and SEC guidelines when buying or selling company stocks. This adherence is crucial as executives and insiders are subject to insider lockup rules, which govern the timing and manner in which they can trade company stock to prevent potential misuse of privileged information.

Supplemental Income Tax

RSUs are a great way to invest in your future and earn additional income, but there are some things to consider in terms of taxes. RSUs are subject to supplemental income tax. The amount of supplemental income tax that you owe depends on your total taxable income, the type of income, and the state you live in. RSUs, once vested, are treated as supplemental wages, subject to withholding taxes. Whether you opt to retain or sell the vested stocks after the vesting date, these stocks will be reflected on your paystub. Consequently, associated income and payroll taxes will be automatically withheld from the vested stocks.

If you receive RSUs, the amount of supplemental income tax that you owe is based on the fair market value of the RSUs when they vest. This means that if the value of the RSUs increases over time, the amount of supplemental income tax you owe will increase as well. It is important to note that the amount of supplemental income tax you owe on RSUs is not always the same as the amount of ordinary income tax you owe. Therefore, it is important to understand the tax implications of RSUs to ensure that you are making the most of your investments.

The standard withholding rate for supplemental wages is typically 22%, rising to 37% if supplemental wages exceed $1,000,000. Additionally, various other taxes apply, such as NY income tax at 11.7%, NYC resident tax at 4.25%, Medicare tax at 1.45%, and an additional Medicare tax of 0.9% if total wages surpass $200,000. Social Security tax at 6.2% (up to the wage limit), NY paid family leave taxes at 4.55%, and NYSDI at 0.5% also factor in.

Understanding RSUs and Estimated Tax Payments

Imagine receiving a $200,000 signing bonus that vests over four years. The calculation involves dividing the $200,000 by the average stock price observed over the preceding 20-30 days, let’s say it’s $100, resulting in 2,000 units. Note that they’re termed as “units,” distinct from conventional “shares.” Upon receiving these 2,000 units, typically, an initial 25% or 500 units vests within the first year. Subsequently, a structured vesting schedule, often quarterly or semi-annually, follows suit.

Suppose the stock price increases to $110 within a year. If your vested amount totals 500 units x $110, amounting to $55,000, this sum is considered taxable income. Upon vesting, a portion of the taxes is withheld, while any remaining balance (if insufficiently covered through estimated tax payments) becomes due by April 15th.

For high earners, even with federal and state withholdings, additional estimated tax payments might be necessary to avoid penalties for underpayment of taxes during the year. Seeking guidance from a financial professional can help plan tax liabilities and prevent unexpected year-end tax bills.

RSUs and Capital Gains

When it comes to RSUs, the capital gains tax rate depends on how long the RSUs have been held. If the RSUs have been held for more than one year, they are subject to long-term capital gains tax rates, which are typically lower than short-term capital gains tax rates. Conversely, if the RSUs are held for less than one year, they are subject to short-term capital gains tax rates. Long-term capital gain generally offers more favorable percentages on the gain, making it a preferred option in terms of tax implications.

By understanding the rules and regulations associated with RSUs and capital gains taxes, you can make more informed decisions about your investments and plan accordingly for any potential tax implications.

RSU Risks

Many people, even after their stocks vest, remain uncertain about their next steps, allowing the accumulation of stock value over several years. As the stock value and capital gain increase significantly, a situation of concentrated stock risk can emerge. Crafting a strategic approach to gradually sell and diversify your portfolio can mitigate the risks associated with concentrated stocks. Proactive management of RSUs is essential to mitigate concentration risk, company-specific risk, and unsystematic risk. Strategizing the disposition of near-future vesting stocks can optimize your assets, potentially transforming them into retirement assets for your long-term financial stability.

Final Thoughts

Understanding the tax implications of RSUs and planning accordingly can ensure a smoother financial journey without surprises come tax time. Consulting with a financial planner, who is savvy in optimizing and strategizing the equity compensation, can provide clarity and prevent potential tax burdens.

If you’re a tech professional prioritizing family time and personal passions over diving deep into RSUs or other equity compensation intricacies, we understand. Your time is precious, and as a busy professional excelling in other areas, we’re here to support you. At Align Financial, our services are tailored to individuals like you. We specialize in guiding women in tech through equity compensation, securing their financial wellbeing.

Beyond financial gains, our focus encompasses your overall financial and mental wellness. As a firm led by women who understand the dynamics of a male-dominated industry, our mission is to empower and educate women in tech. We’re dedicated to understanding your unique needs and freeing up your time, allowing you to prioritize what’s truly important in your life. Reach out to us today to begin crafting wealth strategies aligned with your most valued priorities.

Related Articles

In this informative section, we’ve gathered several related articles that delve even deeper into the intricacies of Restricted Stock Units (RSUs) to enhance your understanding and help you navigate the potential benefits and pitfalls of this popular form of employee compensation. Whether you’re an employee seeking to make informed decisions about your equity compensation, an employer looking to optimize your compensation packages, or an investor trying to understand the impacts of RSUs on shareholder value, these articles offer valuable insights.

https://carta.com/blog/rsu-restricted-stock-unit/

https://hbr.org/2021/08/everything-you-need-to-know-about-stock-options-and-rsus

https://www.investopedia.com/articles/tax/09/restricted-stock-tax.asp

https://www.barrons.com/advisor/articles/rsus-popular-options-advisors-51663776779

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Securities and advisory services offered through LPL Financial, A Registered Investment Advisor. Member FINRA/SIPC.