Since President Trump’s sweeping tariff announcement on April 2—dubbed “Liberation Day”— markets have been anything but calm. The S&P 500 plunged nearly 5% in a single day, and volatility has remained high as global trade tensions continue to rattle investor confidence. If you have stock options, you might be wondering how all of this impacts you. One of the most common consequences of a market downturn is the emergence of underwater stock options—when your company’s stock price falls below your exercise price.

In practical terms, this means exercising your options would cost more than the stock is currently worth, making them temporarily worthless on paper. It’s a frustrating spot to be in, especially if your options were a key part of your compensation.

But don’t panic—being underwater doesn’t mean all is lost. Let’s take a closer look at what this means for you and how to navigate your next steps.

Table of contents

What Does It Mean to Have Underwater Stock Options?

Long-term investors expect markets to rise and fall over time. And historically, markets have gone up more than they’ve gone down, making it easier to stay the course during temporary dips.

But if you have stock options through your job, those ups and downs can feel more personal—because they directly affect your compensation.

Stock options give you the right to buy your company’s stock at a fixed price, known as the exercise price. But they come with conditions:

- Vesting – the amount of time you must wait before you can exercise your options.

- Expiration date – the date by which you must act.

These restrictions can make short-term market drops more stressful, because if the stock doesn’t recover in time, your options could expire underwater.

Let’s walk through an example:

Suppose your employer grants you 1,000 stock options with an exercise price of $50 per share. The options vest over four years (25% each year), and they expire 10 years from the grant date.

Now, imagine it’s year 9. Your options are fully vested, and the expiration date is approaching. Ideally, you’d exercise your options when the stock price is above $50—for instance, $75 per share. That way, you could immediately sell your shares for a profit:

- ($75 per share – $50 per share) x 1,000 shares = $25,000 profit

But instead, your company’s stock drops to $30 per share, pushing your options underwater. In other words, it doesn’t make financial sense to exercise them since you’d be paying $50 for something worth only $30.

This doesn’t mean you’ve lost money—if the stock rebounds before your options expire, there’s still a chance to benefit. But if they expire worthless, it could significantly reduce the value of your overall compensation.

4 Strategies for Dealing with Underwater Stock Options

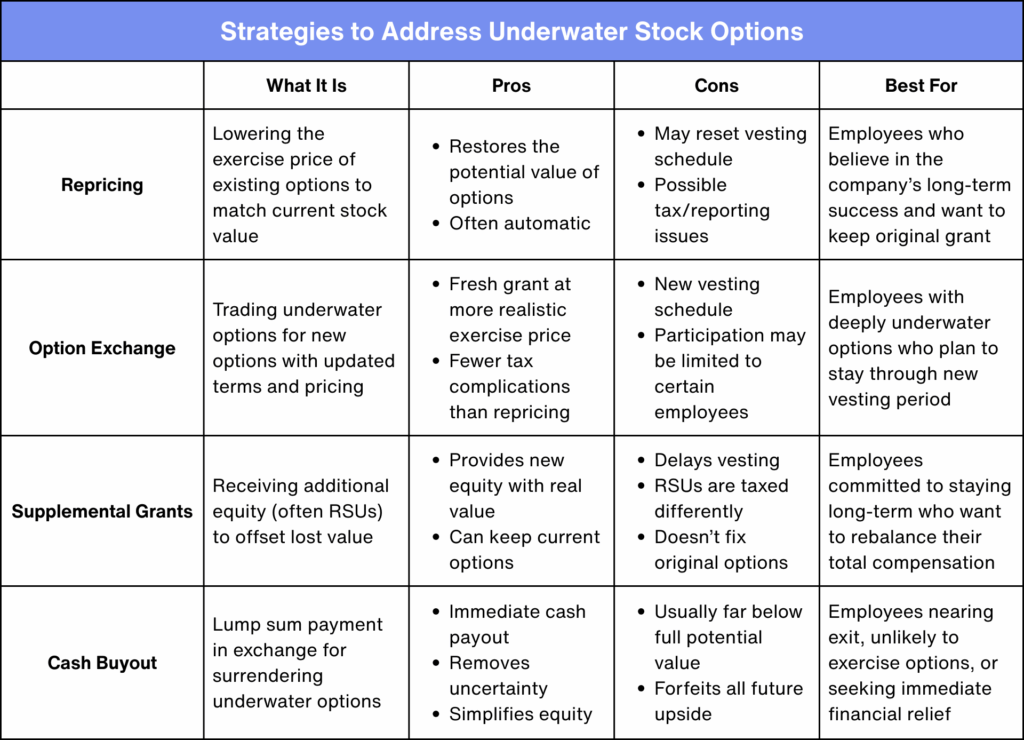

If your stock options are underwater, it doesn’t mean you’re out of luck. Many companies recognize the impact this can have on employees and may offer solutions to help offset the loss in value.

Below are a few common strategies employers use to address underwater stock options—and how they might work in practice.

#1: Repricing Options

Repricing is when your company lowers the exercise price of your stock options to match the current market value.

For example, if your exercise price is $50 but the stock is now worth $30, the company might lower your exercise price to $30. This makes it more likely you’ll be able to make money from your options in the future.

Pros of repricing:

- Potentially makes your options valuable again without needing new ones

- Helps preserve the overall value of your compensation package

- Usually easy to accept—just agree to the new terms

Cons of repricing:

- Your options may come with a fresh vesting schedule, delaying when you can exercise

- If your original options have already vested, repricing could create tax or administrative complexities

- There’s still no guarantee the stock price will rise above the new exercise price

If you believe your company’s stock will bounce back, repricing can give your existing options a fresh start without starting from scratch.

#2: Option Exchanges

An option exchange lets you trade in your underwater stock options for new options with a lower exercise price and updated terms.

Like repricing, it’s a way to realign your equity compensation with the company’s current stock price. However, instead of adjusting your existing options, you’re issued an entirely new set.

Suppose your original exercise price is $60, but the stock is now trading at $35. Your company may offer you the opportunity to exchange your options for a new grant with a $35 exercise price and a new four-year vesting schedule.

Pros of option exchanges:

- Resets your equity at a more realistic price, increasing your chances of future gains

- Provides a clean slate if your original options are unlikely to recover

- May involve fewer tax complications compared to repricing

Cons of option exchanges:

- You’ll likely have to wait again for the new options to vest

- Not everyone may be eligible to participate

- There’s still no guarantee the stock price will rise above the new exercise price

If your current options are far underwater and unlikely to bounce back, an exchange can give you a second chance. However, it only makes sense if you plan to stick around long enough to earn the new grant.

#3: Supplemental Grants

When your options are deeply underwater, some companies may offer extra stock to keep your total compensation fair and competitive. These are called supplemental equity grants and often come in the form of new stock options or restricted stock units (RSUs).

For example, if your original options have dropped significantly in value, your company might grant you $10,000 worth of RSUs that vest over two years. This doesn’t change your old options, but it gives you a new chance to benefit if the stock goes up.

Pros of supplemental grants:

- Provides new equity with immediate value

- Enhances your total compensation without requiring you to give up your existing options

Cons of supplemental grants:

- New awards typically come with a vesting schedule, delaying full ownership

- Grants may be smaller in size or limited to select employees

- Doesn’t improve the value of your original, underwater options

If you plan to stay with your company, supplemental grants can help bridge the gap left by underwater options. Just keep in mind that RSUs are taxed differently than stock options, so it’s wise to plan ahead for the potential tax impact.

#4: Cash Buyouts

In certain situations—such as a merger, acquisition, or company restructuring—your employer may offer a cash buyout for your underwater stock options. This means they’ll pay you a set amount per option in exchange for giving them up.

For instance, if your options have an exercise price of $50 and the stock is trading at $30, the company might offer $2 per option. Essentially, it’s a one-time payment for options that are unlikely to become valuable.

Pros of cash buyouts:

- Delivers immediate cash you can put to use right away

- Eliminates the uncertainty of waiting for the stock to recover

- Simplifies your financial picture by closing out your old options

Cons of cash buyouts:

- Payouts are usually a fraction of your options’ original potential value

- You forfeit any future upside if the stock rebounds

- The lump sum is usually taxed as ordinary income in the year it’s received

Cash buyouts can make sense if you don’t think the stock will recover—or if you’d rather take a guaranteed payment now instead of holding out for a possible comeback.

What If Your Employer Doesn’t Offer a Formal Solution?

If your company isn’t offering a fix, you’re not out of luck—just out of formal options. There are still smart steps you can take:

- Review your stock option details. Check the expiration dates, vesting schedule, and how long you have to exercise after leaving the company. You might have more time than you think—many stock options last up to 10 years. If you believe your company will bounce back, it could be worth waiting.

- Reevaluate your pay package. If your options are deep underwater, consider asking for extra stock, a bonus, or other benefits during your next review to make up for the lost value.

- Use it as leverage. If you’re job hunting, be upfront about your current equity being underwater. It’s part of your total compensation story and may help you negotiate a stronger offer.

Lastly, talk to a financial advisor. They can help you think through your options, understand the tax impact, and make sure your strategy supports your long-term goals.

Navigating Underwater Stock Options

When your options go underwater, it’s easy to feel like the rug’s been pulled out from under your compensation plan. But here’s the good news: you have options, even when your company doesn’t offer a formal fix. The key is to stay informed, evaluate your choices carefully, and make decisions that align with your long-term objectives.

If you’re unsure what to do next, you don’t have to figure it out alone. At Align Financial Solutions, we specialize in helping women in pharma and tech navigate the complexities of equity compensation. From evaluating your options to avoiding tax pitfalls, we’ll help you make confident, informed decisions that support your goals.

Ready to turn your equity into a meaningful part of your financial future? Schedule a complimentary intro call to get started.

Disclosure

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Stock investing includes risks, including fluctuating prices and loss of principal.

Securities and advisory services offered through LPL Financial, A Registered Investment Advisor. Member FINRA/SIPC.