Key Points:

- Vested RSUs are taxed at vesting, so your decision to sell or hold should be based on your financial goals, risk tolerance, and overall strategy—not just taxes.

- There’s no one-size-fits-all approach; you can sell immediately, hold, or use a blended strategy to balance risk and reward.

- Coordinating your RSU strategy with tax planning and your broader financial plan helps you make the most of this opportunity and avoid costly surprises.

Table of contents

When your Restricted Stock Units (RSUs) vest, it can feel like a sudden windfall. After months or even years of waiting, the shares are finally yours. But with vested RSUs comes a new set of decisions: Should you sell right away? Hold on for potential growth? What about the tax implications?

RSUs can be a valuable form of compensation, especially in industries like tech and pharma, but they also come with layers of complexity. Understanding what happens when RSUs vest and crafting a strategy around that moment can turn this opportunity into meaningful, lasting progress toward your financial goals.

What Happens When RSUs Vest?

Before you can build a strategy, it’s essential to understand how RSUs work. Unlike stock options, RSUs represent actual shares of company stock that become yours once certain conditions are met—usually based on time or performance milestones.

Once your RSUs vest, the shares are yours to keep, but they’re not exactly “free money.” At the moment of vesting, the value of the shares is considered ordinary income.

That means you’re taxed on the fair market value, regardless of whether you sell them or not. In other words, your decision to sell or hold should be guided by your financial goals, risk tolerance, and overall investment strategy—not just by the desire to reduce your tax bill.

Why Selling Vested RSUs Immediately Might Make Sense

For many employees—especially those early in their wealth-building journey or heavily invested in their employer’s success—selling RSUs right after they vest can be a smart move. Here are some of the most compelling reasons to consider selling vested RSUs immediately:

- Avoid concentration risk. If your income, benefits, and RSUs all come from the same company, you’re highly exposed to a single source of financial risk. Selling helps reduce home stock exposure and adds balance to your overall portfolio.

- Lock in gains and avoid losses. RSUs are taxed based on their value at vesting. If the stock price drops afterward, you could end up paying taxes on income you never actually pocket. Selling right away eliminates this risk.

- Boost cash flow for near-term goals. Whether you’re saving for a down payment, tackling student loans, or building an emergency fund, converting RSUs into cash can help you make faster progress toward your financial goals.

- Simplify your decision-making. Selling immediately removes the emotional guesswork around market timing. You can reinvest the proceeds in a diversified portfolio that’s aligned with your long-term plan—no crystal ball required.

Ultimately, selling at vesting allows you to turn a potentially volatile asset into a strategic tool for building financial stability.

When It Might Make Sense to Hold Vested RSUs

While selling vested RSUs immediately is a common strategy, holding onto your shares can also be a smart move, especially if you believe in your company’s long-term potential and are financially prepared to ride out market fluctuations. Here are a few reasons why holding might make sense:

- Potential for long-term capital gains. If you hold your shares for at least one year after vesting (and two years after the grant date), any gains may qualify for long-term capital gains tax rates, which are typically lower than ordinary income tax rates. This can improve your overall after-tax return.

- You don’t need the cash right away. If you’ve already built a strong financial foundation—complete with a healthy emergency fund, no high-interest debt, and consistent retirement savings—holding onto your RSUs could be a reasonable long-term investment.

- You believe in your company’s future. If you’re confident in your employer’s long-term growth and can tolerate the risk, holding may offer upside potential. Just be mindful of home stock syndrome—the tendency to overvalue your company’s stock simply because it feels familiar or emotionally safe. Familiarity doesn’t always equal financial soundness.

- You’re comfortable with volatility. Stocks, especially in growth sectors like tech and pharma, can swing dramatically in value. If you’re prepared for those ups and downs and can stay invested without making emotional decisions, holding may work for you.

Holding vested RSUs isn’t right for everyone. However, for those with a high risk tolerance and a strong financial safety net, it can be a strategic part of a long-term wealth-building plan.

Blending Strategies: A Phased or Tiered Approach

You don’t have to choose between selling all of your vested RSUs or holding them indefinitely. Many people find that a blended approach offers the right balance of risk management and opportunity.

Here are a few ways to structure a hybrid strategy:

- Sell a portion at vesting. Consider selling just enough shares to cover taxes, fund short-term goals, or reduce concentration risk while holding the rest to benefit from future upside.

- Use a “sell-to-cover” strategy. Automatically sell enough shares to cover your tax bill and keep the remaining shares.

- Create a consistent rule-based approach. For example, you might decide to always sell 50% of your vested shares immediately and reevaluate the remaining shares each year. This kind of system helps remove emotion from the process and avoids the pitfalls of trying to time the market.

A tiered strategy can help you stay proactive and intentional with your RSUs while giving you room to adapt as your financial situation and goals evolve.

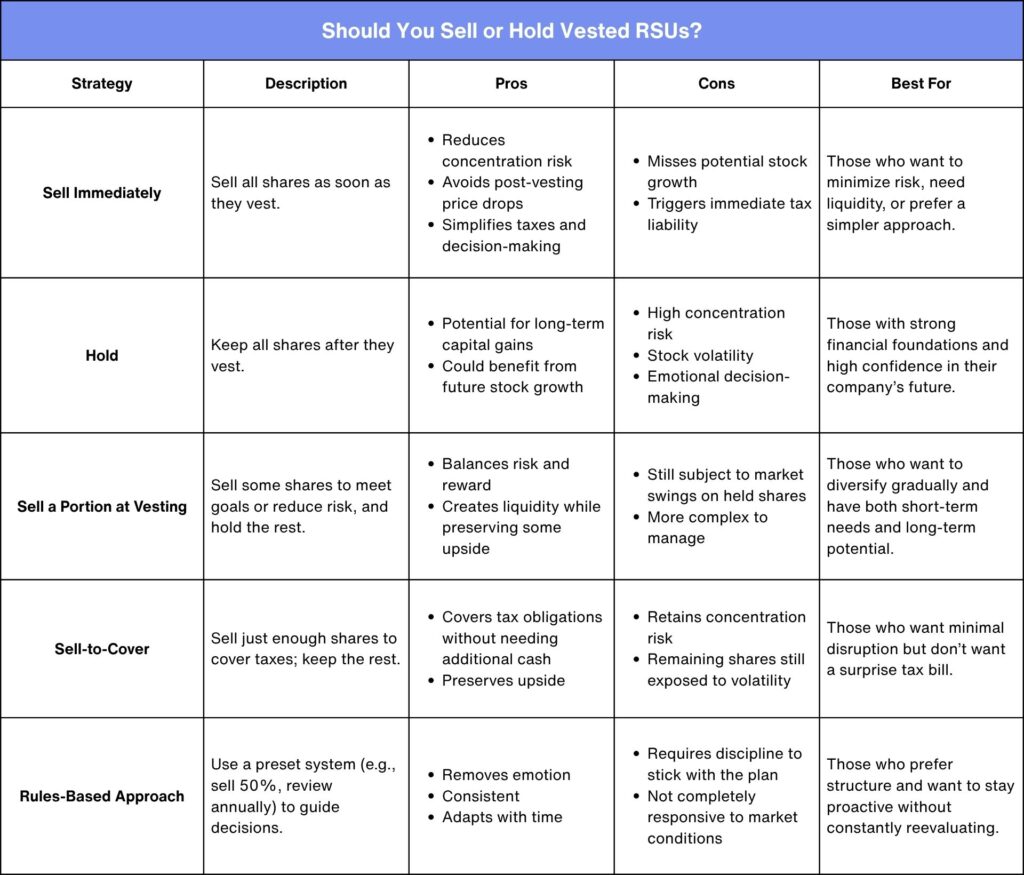

Below is a quick recap of each RSU strategy—what it involves, the potential benefits and drawbacks, and who it might be best suited for:

Tax Optimization Considerations

Taxes are one of the trickiest parts of managing vested RSUs. While they shouldn’t drive every decision, it’s important to factor them into your overall strategy.

Here are a few key points to keep in mind:

- Employer withholding may fall short. Most companies withhold taxes at the IRS’s flat supplemental rate—22% for most employees or 37% for higher earners. If you’re in a higher tax bracket, you could end up owing more than what was withheld. Planning ahead with estimated tax payments can help you avoid surprises.

- Watch for AMT triggers if you have ISOs. If you’ve also been granted incentive stock options (ISOs), the combination of exercising options and RSU vesting could impact your exposure to the Alternative Minimum Tax (AMT). A tax advisor can help you evaluate and manage this risk.

- Coordinate with other tax strategies. You may be able to offset some of your RSU-related gains through tax-loss harvesting, or by timing charitable contributions for maximum tax efficiency. Integrating your RSU strategy with your broader tax plan can make a meaningful difference.

Proactive tax planning won’t eliminate your tax bill altogether. However, it can help reduce it, smooth out your cash flow, and help you make smarter decisions with your equity compensation.

Aligning RSU Strategy with Your Broader Financial Plan

While it’s tempting to focus on stock performance or the excitement of vesting day, your RSUs are just one piece of a much larger financial picture. To make the most of vested RSUs, consider how they fit into your overall plan:

- Define your short- and long-term goals. Think about what you’re working toward—for instance, buying a home, starting a business, building generational wealth, or retiring early. Your RSU strategy should support those goals and move you closer to achieving them.

- Assess your risk tolerance and time horizon. If you’re younger with decades to invest, you may be more comfortable holding company stock and riding out volatility. But if you’re nearing a major milestone—like starting a family or changing careers—liquidity and stability might take priority.

- Integrate with your full financial plan. RSUs shouldn’t be managed in isolation. Consider how they interact with your cash flow, retirement savings, investment portfolio, and taxes. A coordinated approach typically leads to better outcomes.

- Work with a professional. Equity compensation can be complex. Partnering with a financial planner or tax advisor who understands RSUs can help you avoid common pitfalls and build a strategy that aligns with your lifestyle and goals.

By viewing your RSUs through a holistic lens, you can turn a compensation perk into a powerful tool for long-term financial success.

Making the Most of Vested RSUs

Vested RSUs can be a powerful wealth-building tool, but only if you have a clear plan in place. Whether you decide to sell, hold, or use a blended approach, the key is making a choice that’s intentional and aligned with your personal financial goals.

If you’re feeling uncertain about what to do with your RSUs, you don’t have to figure it out alone. At Align Financial Solutions, we’ve helped employees from companies like Disney, Amgen, and Meta navigate the complexities of equity compensation. Our experience working with women leaders means we understand the unique challenges and opportunities RSUs present, and we’re here to help you make informed, confident decisions that support your objectives.

Let’s build a strategy that reflects your values, priorities, and lifestyle, so your money works as hard as you do. Schedule a complimentary 15-minute Align Call to get started.

Disclosure:

Securities and advisory services offered through LPL Financial, A Registered Investment Advisor.

Member FINRA/SIPC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. We suggest that you discuss your specific tax issues with a qualified tax advisor.